Worth More Dead Than Alive

A new liquidation idea with 30-70% upside potential, downside well-protected, and activists on board (currently, 8% of my portfolio)

This is a guest article from one of our members Hubert Nowak, originally published on Hubert's Substack blog "The Last Puff".

Caveat Emptor

This is a liquidation idea for a small company trading on the AIM market that will most certainly involve holding delisted stock for a few months. Thus, it’s probably not for everyone. The stock is very illiquid, with around 50k average 3-month share trading volume, so applicable only for smaller personal trading accounts. Over the past few weeks, I managed to acquire enough shares to make this position 8% of my portfolio. Although I consider the downside to be very well protected, remember:

This is not investment advice – always do your own due diligence.

Brief Description

Zytronic develops, designs and supplies internationally patented and award-winning PCAP touch solutions.

Our touch solutions are durable, reliable, innovative and can be used across a variety of sectors and applications. We are trusted by major corporations worldwide.

All developed solutions are tailored to your specific business needs. Our comprehensive glass processing facilities allow for fully customised designs, while our flexible processes enable us to develop bespoke touch solutions and rapid prototypes.

We design and develop our own PCAP touch controller electronics based on our extensive IP and therefore, our capabilities allow us to customise our touch controller firmware to fulfil your needs.

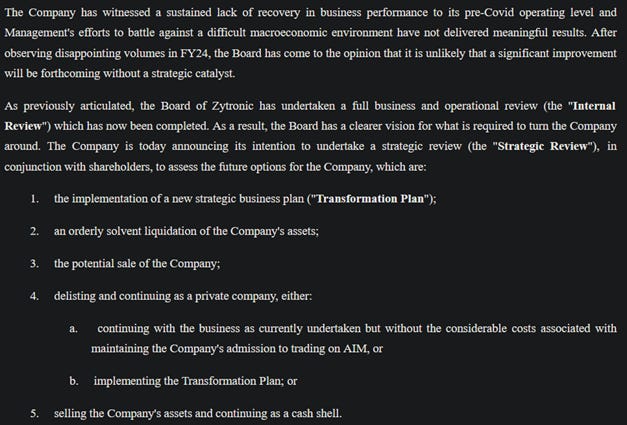

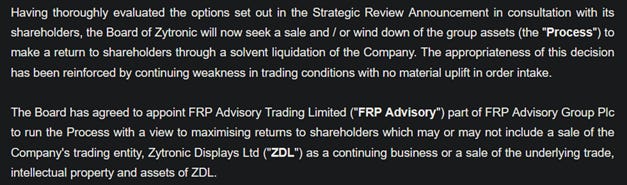

Strategic Review

In mid-October, management initiated a strategic review, which a month later, on the 14th of November, concluded with a decision to either try to sell the company or wind down the assets and return capital to shareholders. The company already appointed advisors to help them find potential buyers:

The press release also mentioned that a report with realizable value estimates should be out in a few weeks, so we should see more information on that soon, as ‘a few weeks’ have already passed.

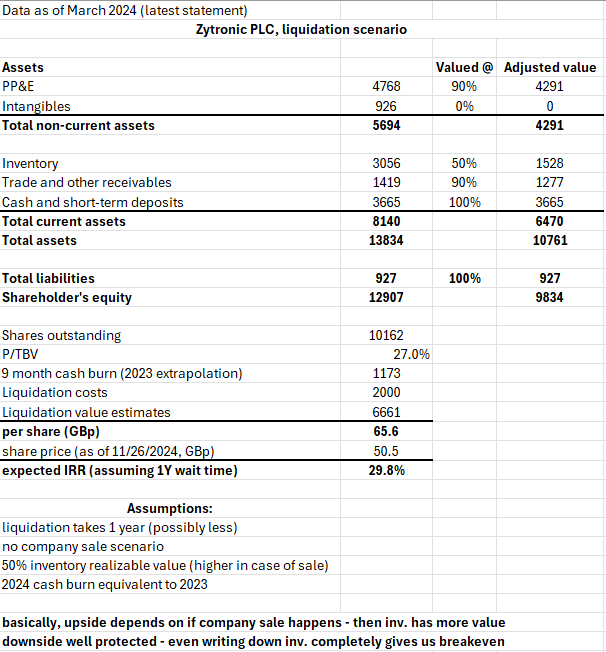

Estimating Liquidation Value

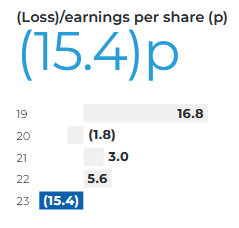

Unfortunately, the latest data we have available is from March 2024, so it’s quite outdated now in mid-December, and so it’s necessary to take some wild guesses (to a certain degree) as to the current NAV. Fortunately, we have plenty of information to work with.

The Conclusion of Strategic Review press release mentioned that the company has a net-cash balance of ~3.3M, which is just 10% lower than the amount seen on the March interim report. My cash burn assumptions used for the liq. value modelling were basically the extrapolation of FY2023 net loss times 3/4 (since, roughly, 9 months have passed from March), but this piece of information from the press release suggests that the actual burn was probably a lot smaller than that. Keep in mind that 2023 was an extraordinarily bad year for the company, so it’s quite probable that the actual cash burn is in fact closer to half of how I modelled it.

Some assumptions have to be made in calculating the potential upside. The best case scenario would probably be the sale of the company, which would maximize the realizable asset value and would also mean the lowest costs.

First, some simple assumptions

On the 31st of March, tangible equity was at £12M. As most of the asset value is either in cash, receivables or properties, which have no real obsolescence risk, we can roughly assume a 25% haircut to NAV, which gives us 9M, or ~88.5p per share. The current share price stands at 52p per share, so based on those assumptions, return on investment in the best case scenario could be +70%. Note that it would also take less time to sell the company, as opposed to fully liquidating it. Also, that does not take into consideration the value of any intangibles.

Then we have the liquidation scenario, which would certainly lower the expected return and make the shareholders wait longer for the eventual payout.

I estimate it should probably take a year or so for the company to be liquidated, as:

1) it’s a small company with not a lot of assets,

2) the actual assets should not be, for the most part, terribly difficult to get rid of – NAV is mostly cash, receivables, properties and raw materials,

3) Activists certainly want to liquidate the sucker as quickly as possible, and it looks like the management has already accepted the fate of the company too and wants to cooperate.

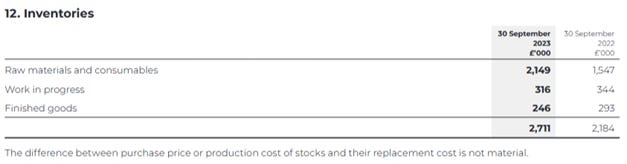

The realizable inventory value is the biggest question here. However, as most of it is in raw materials, I’m assuming we could get at least 50% of the value back if a liquidation were to happen – but more on that later. There’s also obviously the risk that it’d take longer than a year, which would in turn decrease the IRR. It’s hard to be certain about any specific numbers.

Insiders and Activists

Over the past few months, there has been significant buying activity. Henry Spain Investment Services now owns 19% of the company. Peter Hyllenhammar AB, which previously held over 6% of the company, appears to have sold its entire stake as of November 12th, if I understand correctly. It’s possible that Henry Spain acquired that stake. Additionally, there have been a few other disclosures of individuals crossing the 1% ownership threshold. If you’re interested, you can find the filings here.

The board members themselves don’t hold much stock, so Henry Spain now seems to be the single largest shareholder, aside from institutional buyers.

With that in mind, it’s in everyone’s best interest to either sell or liquidate the company as soon as possible. We also have a large shareholder who likely has considerable influence over the process.

The Actual Calcs

One small thing worth mentioning is that, at least during 2023, half of the cash was being held in short-term deposits generating some profit (~200k for FY2023), which can slightly off-set the cash burn.

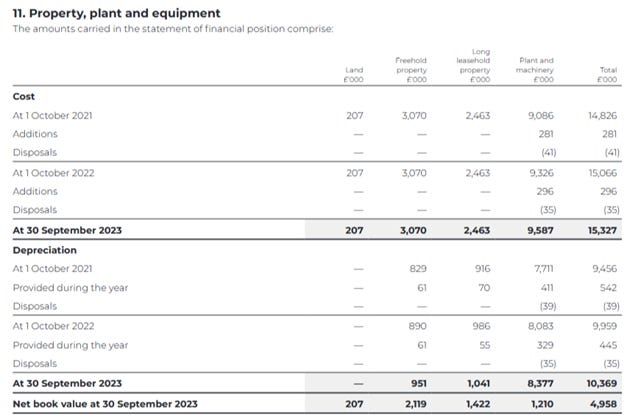

Most of the PP&E value is in properties, with plant and machinery being only 1/4 of that after depreciation, so putting a huge discount here is not necessary.

With inventory, we have a similar case, as most of it is raw materials and consumables, so I’d say there’s a high chance that shareholders get at least 50% of book value. If a company sale should happen, the recoverable value of inventory should be closer to book, but again, it’s difficult to specify any numbers with certainty. Although some things are questionable, there’s plenty of room for good things to happen.

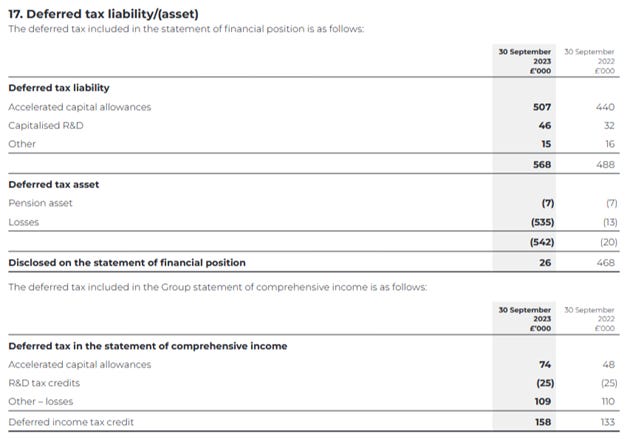

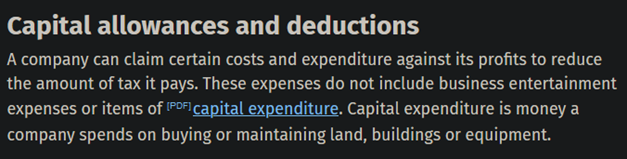

One thing I am not certain about is the tax considerations for ‘Accelerated capital allowances’ during a company liquidation. As per this website:

I’m not familiar with British tax laws, so there might be a risk that the company would have to pay an additional 500k in taxes to reverse this allowance during the liquidation process. Again, if a company were to be sold to a third party, this shouldn’t pose any issues. I’d be glad to learn more about, so if anyone of you knows how the accounting works in this regard, please contact me in the comments section or directly on Twitter.

Also, ZYT.L is listed on the London Stock Exchange under SETSqx trading service:

Stock Exchange Electronic Trading Service: Quotes and Crosses (SETSqx) is a trading service for securities less liquid than those traded on SETS. The auction uncrossings are scheduled to take place at 8am, 9am, 11am, 2pm and 4:35pm

So, in case you’d want to invest, be aware of that trading limitation – GTC limit order is probably the way to go.

Quick Summary

In the base case scenario, which involves a company sale, the potential return could be as high as 60-70%, assuming a 25% haircut to the current NAV. Even if the management is unable to find a buyer, they can (and certainly will) still proceed with liquidating the company.

In the liquidation scenario, the potential return could be up to +30%. And even if the entire inventory proves to be worthless, we would still break even.

Given the significant downside protection, this opportunity provides a compelling risk/reward profile. While the outcome hinges on a potential sale, the current price reflects significant undervaluation, even under conservative assumptions, and this investment should give the shareholders some rather satisfactory returns even considering the liquidation scenario.

This provides me with a wide enough margin of safety, which personally also makes me quite comfortable with Zytronic being a fairly large portfolio position now.

I wish you good luck and happy hunting!

Stonks Value

2/21/2025 Update:

We have yet another update.

Unfortunately, sale is now out of the picture, so a solvent liquidation will be happening. I'd say it was pretty clear that a solvent liquidation was the most probable option, but it looks like there were some people speculating solely on the 'sale prospects', that just sold when that idea recently died.

The stock price fell from 54p to below 40p, and I managed to buy more shares at 42p. Zytronic is now 20% of my portfolio. Average price now stands at ~48p per share.

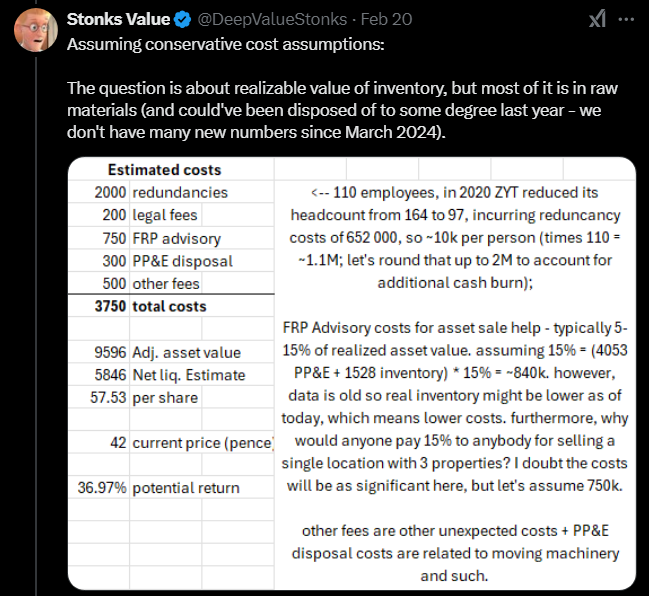

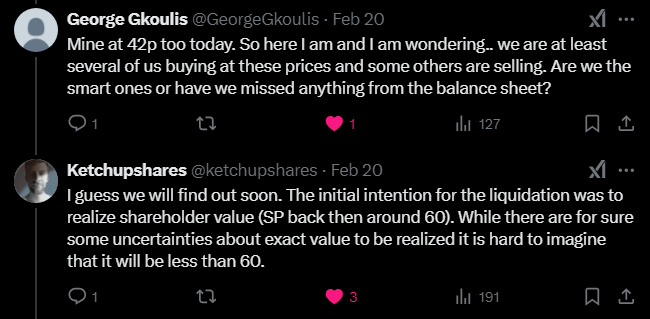

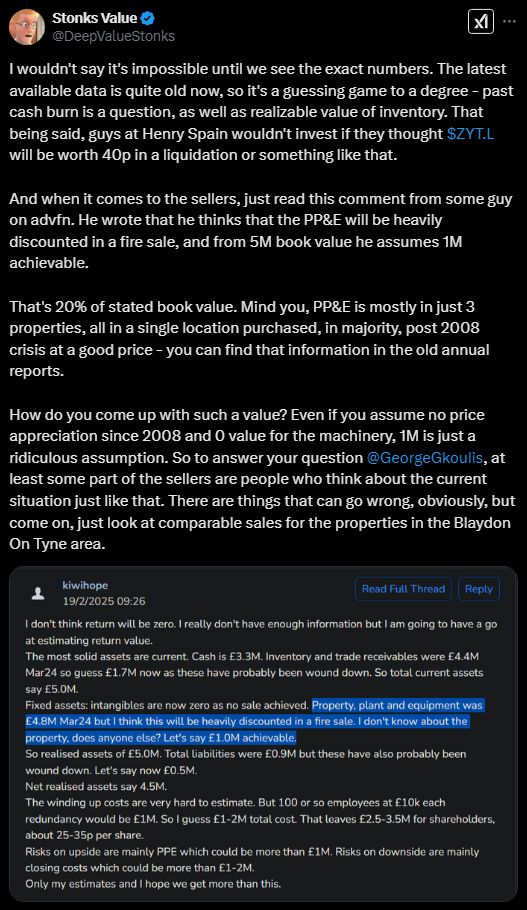

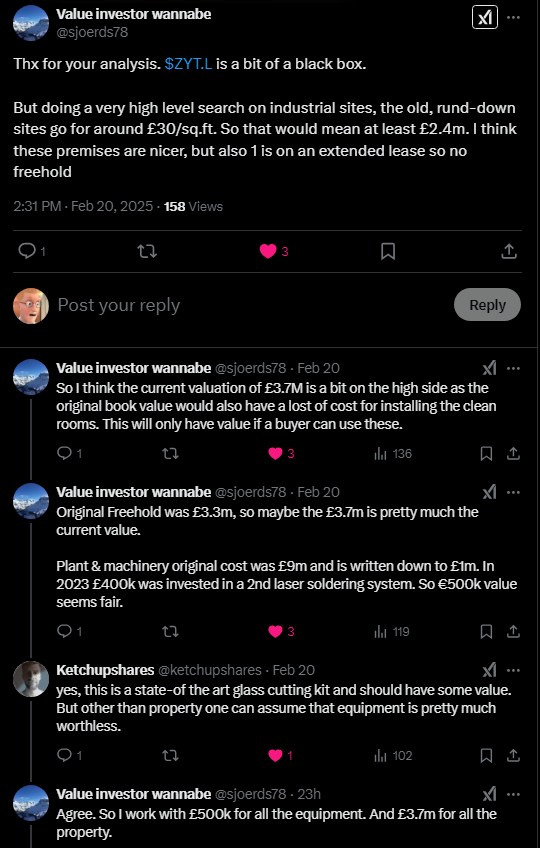

There was a nice discussion on that on Twitter as well:

2/3/2025 Update:

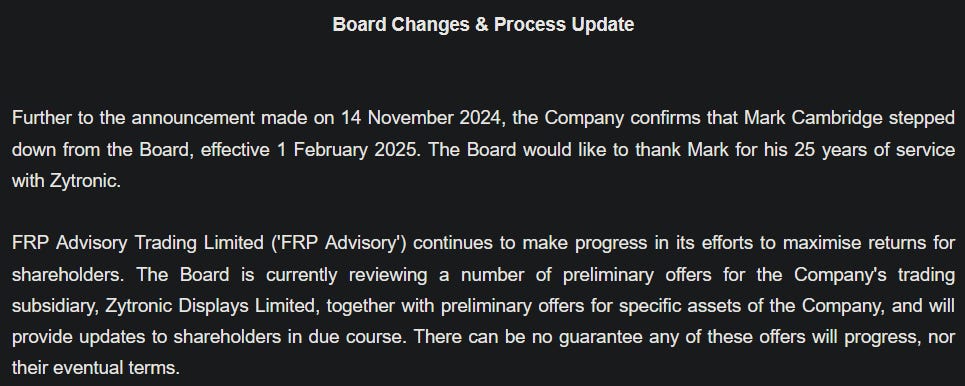

The company just issued a press release stating that the CEO, Mark Cambridge, has stepped down from the board. This is certainly a positive development, considering all the cost savings on employee expenses during the liquidation.

Additionally, the release confirmed that there have been offers for the company’s subsidiary, as well as for certain assets. This is good news, as it indicates that there are interested parties for the assets to be sold, which reduces uncertainties surrounding the liquidation process to a degree.

Zytronic still is my single largest position currently, at ~15% of AUM.

A few things

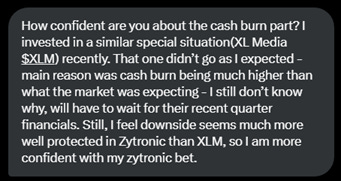

My friend NoBrainerStocks raised a very good question regarding the potential cash burn for Zytronic, the answer to which, I thought, would be a great addition to my previous writeup.

Whenever you buy shares of a company pursuing liquidation, there are numerous risks involved. One significant risk is excessive cash burn, which can erode potential upside, ultimately reducing your IRR. Realistically, unless one is a current employee or a well-informed industry professional, cash burn projections often amount to educated guesses rather than precise calculations.

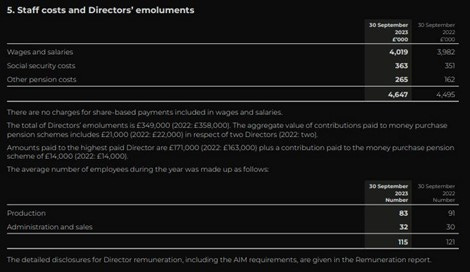

In the case of Zytronic, we have a tiny company with a market cap barely reaching £5.5M, a straightforward operating business, and activists on board aiming to maximize returns through solvent liquidation. The primary costs here are tied to wages and salaries. From what I’ve heard, most of the staff have already received redundancy notices, significantly shrinking this cash burn factor:

As it is quite tricky to estimate specific figures, my approach here would be to estimate a margin of safety for potential cash burn, identifying the threshold where the investment could turn into a loss-making one.

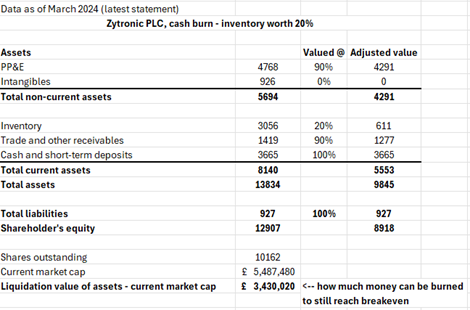

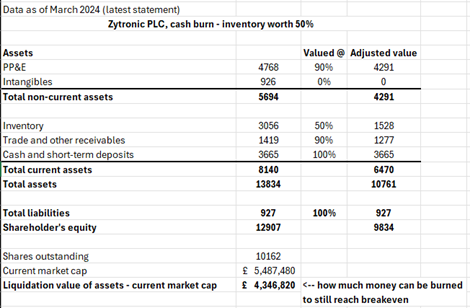

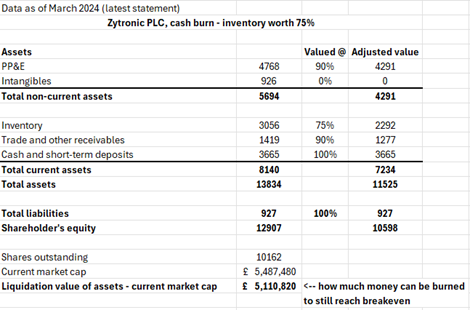

The most uncertain asset here is the inventory. To address this, I’ve modeled three scenarios based on different realizable values for the inventory: 75% (best case), 50% (base case), and 20% (worst case). Each scenario helps to estimate how much cash would remain to absorb potential cash burn while still avoiding losses:

Worst case scenario: Inventory realizable value of 20%.

Base case scenario: Inventory realizable value of 50%.

Best case scenario: Inventory realizable value of 75%.

Additionally, as noted in the original article, a delisting could be on the table, as maintaining a public listing involves ongoing costs - audit fees, accounting, investor relations, exchange fees, etc. Delisting could slow cash burn to a slight degree.

Even in the worst case scenario of 20% realizable inventory value, assuming cash burn since March 2024 (the most recent available data) equals the extrapolated 2023 loss, we arrive at roughly £2M of liquidation value. This seems sufficient to cover liquidation costs, especially considering most staff members have already been laid off and a solvent liquidation is the clear objective. So, even if the most questionable part of this liquidation (inventory) turns out to be almost worthless, we still don’t lose money on this investment.

Expected Value

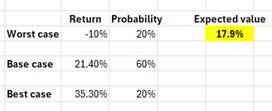

Of course, this isn’t a foolproof scientific approach, and things could go wrong. However, assessing the entire situation as a whole, I find confidence in the positive EV this investment offers:

- If we assume the inventory is worthless (worth 0%), extrapolate the 2023 loss (9 months since March), and estimate liquidation costs at £2M, we’re looking at a modest -6.5% loss. For the purpose of calculating the expected value of this investment, let’s round that to a -10% return with a 20% probability.

- The base case assumes a 50% inventory realization, the same cash burn, and £2M liquidation costs, resulting in a 21.4% return with, say, 60% probability.

The best case assumes a 75% inventory realization, with other assumptions unchanged, delivering a +35.3% return with a 20% probability.

Combining these probabilities, we get an expected value of +17.9%, based on conservatively estimated costs, intangibles being valued at zero, and properties sold at book value (without appreciation since purchase).

If the liquidation process takes a year, this doesn't necessarily equate to the effective IRR, as partial cash distributions are often made throughout the process, which means we would get some part of the initial investment back earlier. Zytronic also holds a substantial cash balance, which makes early distributions even more probable.

Value Investor On Board

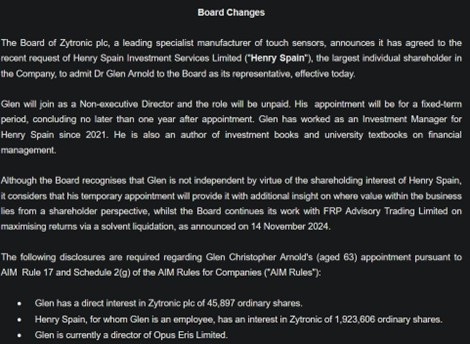

Finally, there’s a new development strengthening the thesis: a value investor has recently joined the board as a non-executive director, at the request of Henry Spain. Last month, a press release confirmed Dr. Glen Arnold’s appointment, who was brought in, I assume, to oversee the liquidation process more closely. His involvement further reinforces my conviction in this investment.

Interestingly enough, Dr. Glen Arnold is an author of quite a few books on Warren Buffett and investing in general. I hope he’s also a strong believer in Buffett’s cardinal rule: ‘Never lose money’.

After all, why would they want to buy 1/5th of the whole company if not for profit?

On Sizing

Over the past few weeks, I have been steadily accumulating shares of Zytronic, which now make up approximately 15% of AUM. While the upside may not appear that extraordinary, I view this as a highly attractive bet with a wide margin of safety and high upside potential (possibly understated current property value, intangibles can turn out to be worth something, liquidation can take less than what I assume, etc.).

Given our substantial cash reserves (previously almost a third of the portfolio was held in cash) I felt confident in committing a larger sum to this opportunity.

As they say, ‘Focus on the downside and the upside will take care of itself’.

Nonetheless, it’s obviously not arbitrage. Always do your own due diligence.

Acknowledgement

I’d like to thank Mr. Ketchupshares for reminding me that Zytronic exists. I’ve had it on my watchlist for some time, but it was his post that convinced me to take a closer look. I would appreciate you leaving a ‘like’ if possible :)

I wish you good luck and happy hunting!

Stonks Value

This is not investment advice. Do your own due dilligence before ever investing in anything.