The Value of Institutional Capital Market Assumptions for Retail Investors

What are Capital Market Assumptions?

Capital Market Assumptions (CMAs) are documents that provide investors with market analyses and forecasts for various asset classes. These reports, sometimes referred to as Long-Term Capital Market Assumptions or simply Market Outlooks, are published by major financial institutions and asset management firms. Typically released annually, they are designed to inform investment decisions of portfolio managers, private bankers, business leaders and retail investors. CMAs usually cover a wide range of financial and economic analyses. The key elements include long-term forecasts for major stock indices, bond yields, foreign exchange rates, commodity prices and an outlook for alternative asset classes. Additionally, they feature a macroeconomic section that looks at factors such as GDP growth, interest rates, inflation, structural economic forces and phases of business cycle for major economies. While most focus on the long-term horizon (10-15 years), some also offer short-term (6-12 months) tactical views of the market.

Why do CMAs matter?

Capital Market Assumptions are valuable due to their long-term, comprehensive perspective, which allows investors to look beyond short-term market fluctuations or daily news and focus on opportunities and risks that truly matter. Such reports usually span 50-100 pages long and offer deep analyses made by top market players. Typically include different scenarios depending on major events and show how different asset classes might react. While CMAs are not financial advice, they can be used as guidance to challenge assumptions and re-evaluate portfolios.

Let’s look at CMAs forecasts

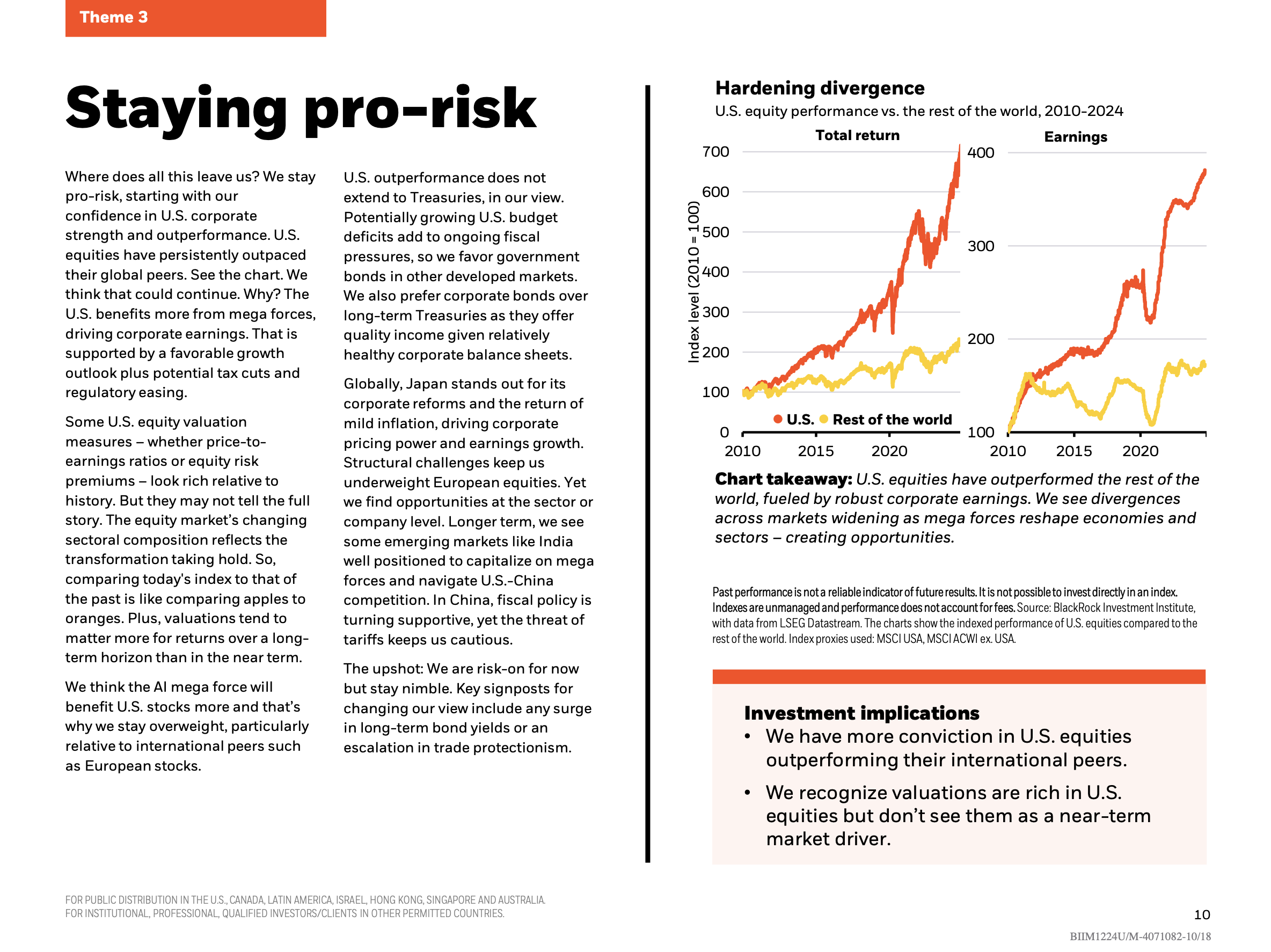

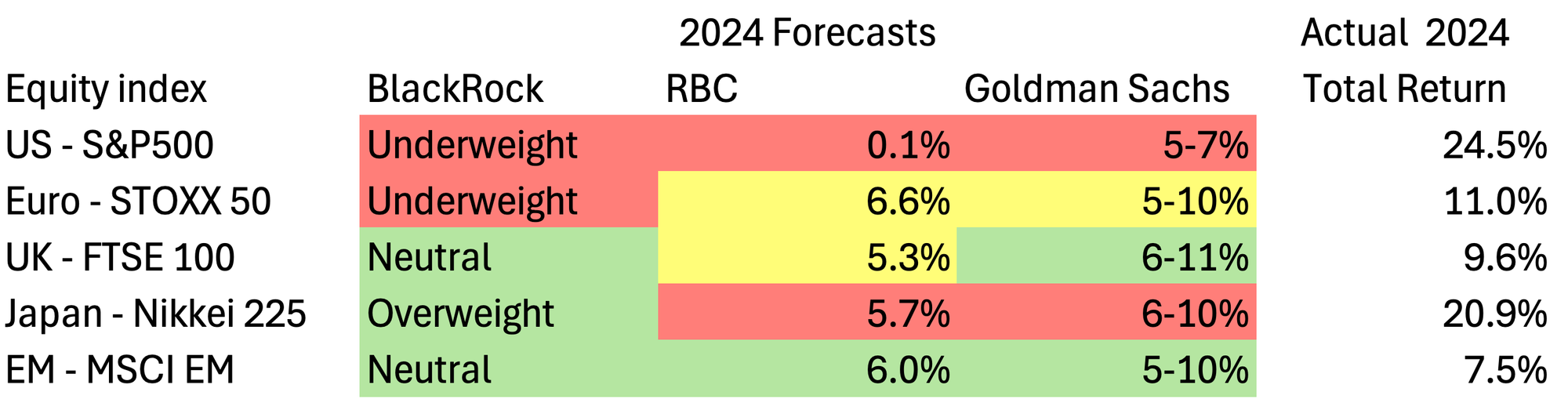

The table compares 2024 market forecasts from BlackRock, Royal Bank of Canada and Goldman Sachs. Each offers a different methodology to guide investors. BlackRock, the world’s largest asset manager, uses tactical positioning – adjusting portfolio allocation by overweighting or underweighting exposure to certain assets. For instance, if the baseline allocation to U.S. equities is 40% and BlackRock expects weak growth due to high valuations, they might underweight the position to 20%. Alternatively, if anticipating a bull run, they could overweight U.S. equities to 60%. Royal Bank of Canada, managing over $800 billion, provides precise one-year total return estimates. While Goldman Sachs outlines return ranges for major indices.

For years, institutional investors have warned about historically high U.S. equity valuations and prospects for weak growth. However, in 2024 the S&P 500 defied these predictions by delivering outstanding returns (+24.5%), driven largely by the dominance of the ‘Magnificent 7’ technology stocks. In contrast, all three asset managers correctly forecasted modest returns for emerging markets equities. These examples highlight a recurring theme that only about half of forecasts prove to be accurate.

Why do CMAs’ forecasts rarely come true?

Capital Market Assumptions or any other market forecasts often fail to predict the future. Financial markets are pricing an enormous number of events happening every day. Even the most sophisticated pricing models used by the world’s largest institutions are limited. Additionally, markets are extremely close to being efficient, meaning prices adjust to new information. This makes it nearly impossible to beat the market consistently, since most data is already priced in. Other than that, CMAs themselves can influence decisions of millions of investors, causing self-defeating prophecies. Another factor are black swan events, in nature impossible to predict events that can significantly affect the world we live in and correspondingly markets. Finally, at the end of the day, all forecasts go through human judgment. Unfortunately, all financiers, traders and economists can make behavioural errors due to psychological factors and environment affecting them. In short, CMAs are best used as tools to think about the future, not as predictions.

S&P Indices Versus Active research

For over two decades, SPIVA (S&P Indices Versus Active) research has been measuring actively managed funds against their index benchmarks. Studies consistently show that a significant majority of active funds fail to outperform passive benchmarks. For instance, only 14% of U.S. actively managed funds and 6% of European funds delivered positive alpha over a 3-year period. And these figures decline sharply when we extend the study period to 5 or 10 years.

Although, SPIVA identified exceptions in niche segments, such as small-cap equities where 51% of U.S. active funds outperform their benchmarks over 3 years, and in less developed markets like South Africa, where 53% of funds delivered alpha over 3 years. Yet again, when considering longer time horizons, between 80-95% of active funds tend to underperform in all measured markets.

The paradox of skill

If increasingly skilled investors compete against each other in highly competitive markets the outcome counterintuitively is increasingly determined by luck rather than the skill itself. In consequence, gaining more expertise and having access to more sophisticated analyses, ultimately does not lead to higher investment returns.

How to benefit from CMAs as a retail investor?

For retail investors, CMAs are most valuable not as forecasts to follow blindly, but as strategic tools to rethink assumptions. Instead of fixating on predictions and headline figures, the focus should be on the analyses behind them: What risk do they flag? What opportunities am I missing? These insights can be used to stress test portfolios against scenarios laid out in reports. Beliefs and biases should be confronted by asking What if I’m wrong? and adjust the portfolio accordingly.

Start by reading annual outlooks from market leaders to shift the perspective away from everyday market news and understand how institutional investors view the market. This can be paired in January with ending the fiscal year, paying taxes, and reviewing personal net worth to grasp the big-picture perspective of the overall financial situation. Over time, this habit can improve decision making, though caution should always be maintained to avoid over confidence and major mistakes.

Recommendations

- Vanguard economic and market outlook for 2025: Beyond the landing

- 2025 Global Outlook: Building the transformation by BlackRock Investment Institute

Preview (page 10)