Meme Stocks

When social media meme culture meets trading.

1 The GameStop Saga

1.1 Prelude

At the beginning of January 2021, financial institutions like Citron Research and Melvin Capital were heavily involved in shorting of a stock of an American “brick-and-mortar” consumer electronics, and gaming merchandise retailer named GameStop Corp. (GME). At the time, it seemed like a god call. The company’s stock price has been steadily declining since November 2015, and their business model has been obviously outdated, with their chain of physical stores being less and less of a competition for electronic and internet distribution platforms like Steam or Epic Games. Even more so during nationwide lockdowns during Covid19 pandemic. In fact, it seemed like such a good call that many other hedge funds joined in on a game, making GME the most shorted stock on Wall Street with 140% of its free float being shorted (Ponciano, n.d.).

1.2 The Trading Redditors

Enter r/wallstreetbets, a subreddit dedicated to young, individual investors who want to discuss their investment strategies, show off their portfolios as well as great earnings and even greater loses, they accumulated. This subreddit is also the birthplace of many stock-market related memes but in January 2021, members of the WallStreetBets community would take part in the creation of the biggest and most impactful one not only in history of the forum but also in the modern history of financial markets.

Contrary to many institutional investors’ opinion, some individual ones believed that GameStop’s stock is significantly undervalued, as the company recorded very stable profits and almost all their shops were net cash positive, despite their more and more obsolete business model.

The most prominent and active investor believing this to be the case was Keith Gill. Known among the WallStreetBets community as “DeepFuckingValue”, but also as a “Roaring Kitty” on X/Twitter and YouTube. Gill would start to invest in GameStop in September 2019 by opening long positions with 50 000 shares and 500 call options for 53 000 USD (GameStop Stock Tipster Roaring Kitty Reveals He Lost $13m in One Day, 2021). Gill regularly posted updates on his position

on WallStreetBets subreddit, thus bringing more and more attention to the GME stock. Attention which eventually resulted in a flood of retail cash into GameStop as hundreds of thousands

of people downloaded Robinhood, the popular electronic trading platform, to join in on the action and thus creating the foundation for the short squeeze (Verlaine & Banerji, 2021).

1.3 The Aftermath

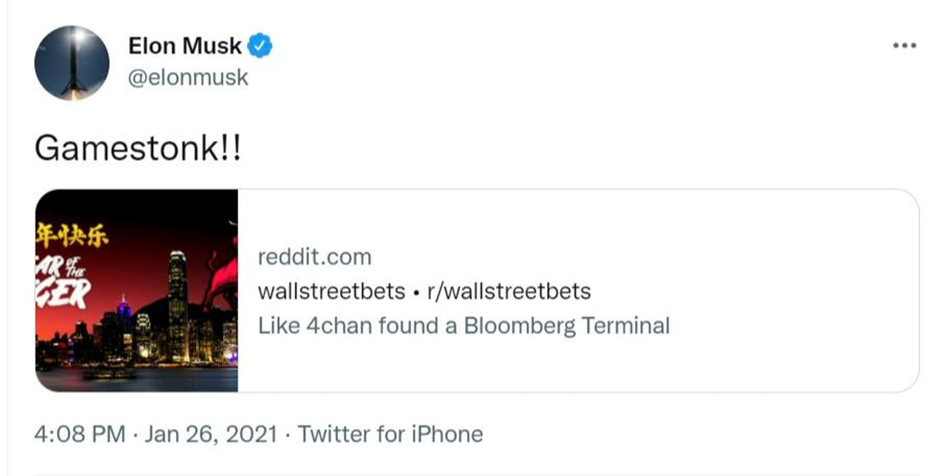

In the end, the rally which culminated in the short squeeze, caused utter chaos on the stock market and absolutely dominated in the financial markets’ media space for days. While the stock price of GME was rising higher and higher, between January 12th to January 28th, the rally attracted more and more attention. On January 22nd, the highest volume is recorded, with over 788.5 million Game Stop shares being exchanged. On January 25th, Melvin Capital, one of the main GME short sellers, finds itself on the brink of bankruptcy but manages to survive thanks only to financial aid from other players in the industry, namely Citadel and Point72 Asset Management (Daniel, 2021). On January 26th Elon Musk publishes a tweeter post saying "Gamestonk!" with a link to the WallStreetBets subreddit. In the next 24 hours, the GME stock price experiences its biggest day-to-day rise in value, with the price hike amounting to 134.84%. On January 27th the phenomenon spills over to another similarly shorted stock, AMC Theatres (AMC), causing another short squeeze. Also that day, U.S. trading volumes (by share count) exceeds the previous record set in October 2008 during the financial crisis, and is the third-highest in dollar terms within the last 13 years on record (Kantor et al., 2021). The highest price of GME stock is recorded on January 28th, briefly reaching an intraday price of 483 USD and even over 500 USD (nearly 30 times the $17.25 valuation at the beginning of January) in pre-market trading hours, the same day.

The rise in GME price was abruptly halted on January 28th when Robinhood with many other trading platforms introducing restrictions on opening long positions on GME and other stocks like AMC or BlackBerry (Rodrigo, 2021). This naturally caused an outrage among the retail investors.

The parent companies of the platforms, however, stated that the restrictions have been implemented due to the change in collateral requirements by clearing houses which due to high volume and volatility of meme stocks, increased required collateral from 1-3% to 100%.

2 The Meme Stock Phenomenon

2.1 So, What Are Meme Stocks?

The GameStop short squeeze became the most famous example of a “meme stock”. The term means a stock which value is driven by the online discussion of large groups of individual investors. The discussion often takes form of meme creation, posting and sharing

(Cho et al., 2024). Although it should be mentioned that in January 2021, not only GME stock was under the effect of the rally. The effect spilled over to other shorted stock like AMC Entertainment (AMC), BlackBerry (BB), Koss (KOSS) and Nokia Corp. (NOK) (“Staff Report on Equity and Options Market Structure Conditions in Early 2021,” 2021). For many individual investors, decisions at that time were not driven by the potential profits but by the potential losses that could be generated for the short-selling institutional investors.

2.2 The Emergence of Meme Stocks

Since January of 2021 the meme stock phenomenon continues to be present on stock exchange although at this point, none of the price hikes have matched the scale and magnitude of the GME stock rally. But the sudden appearance of this phenomenon begs the question: what changed in the trading landscape? There are a few explanations:

1. Easier access to trading – thanks to the digitalization of the stock market infrastructure around the world, it is easier to invest in the global capital market. It is especially noticeable for retail investors.

2. The emergence of commission-free trading – thanks to the elimination of trading commission by some trading platforms, trading became even more accessible.

The pioneer in offering this type of platform was Robinhood Markets, Inc. (Egan, 2019). Their platform “Robinhood” was a trading tool of choice for the big majority of individual investors that took part in the GameStop short squeeze (Darbyshire & Platt, 2021).

3. The presence of capital markets in pop culture – wall street and capital markets, broadly speaking, are more and more embodied in our public awareness thanks to many depictions in popular media. This makes more and more people familiar with trading but only on a very superficial level.

All these culminated in the appearance of a new type of investor.

2.3 Semi-informed Investors

Who didn’t watch “Wolf of Wall Street” or “The Big Short”. These works of culture, and many others, depict the world of capital markets and traders as exciting and dynamic, where the opportunity to get insanely rich lies at every corner. But at the same time, they fail to precisely explain the inner workings of the industry. This culminates in a situation where a lot of people that lack any formal training or knowledge try their best on the market. They see it to easily make some money. This notion is then exploited by the retail trading platform providers, who market their products on social media platforms. And since there are practically no barriers for entry, everyone can set up an account and start making money. At this point a person like that becomes an uninformed investor or a noise trader. Such an investor makes bets that in the big picture are basically random, and is simply taken advantage of by arbitrageurs or rational speculators

(Cho et al., 2024). But thanks to the access to social media, such an investor can take it a step further. When uninformed investors start to communicate with others, on a platform like r/wallstreetbes, their investment pattern becomes less random. Also the goal of such investor often would shitf from profits to impressing other forum members. Which in some scenarios mean that the bets taken by such investors are coordinated using social media and meme sharing and/or creating. This mechanism allows small investors to act as a single large trader, able to successfully manipulate prices (Costola et al., 2021).

2.4 The Consequnces of Meme Stocks for the Capital Markets

The other question regarding meme stocks is a one that is regulatory in nature. Should regulations adress this phenomenon? At this point the opinions are inconsistent at best. From one hand, market phenomenons are seen as a threat to the market stability and GameStop short squeze definitly casued some issues in that area. Some reaserchers consider the phenomenon

as a straight up market manipulation and suggest tightning regulations to adress and prevent

it (Costola et al., 2021). But on the other hand, while some hedge funds, like Citron Research and Melvin Capital mentioned earlier, had big losses, the meme stocks phenomenon did not widely impact hedge funds (“Staff Report on Equity and Options Market Structure Conditions in Early 2021,” 2021). With some institutional investors rethinking their strategies and creating models that could help them find and profit from the next GameStop rally (Darbyshire & Fletcher, 2021). This could mean that after learning their mistakes, hedge funds will return on to their profit making ways and meme stock surge of the magnitude similar to GME rally could never happen again. Also trying to fight this phenomenon with more regulations could, in my opinion, have very serious consequences for the market since regulations would have to adress retail investors and their access to capital market which may be a very significant restriction of economic freedom.

3 Conclusion

The GameStop short squeeze of January 2021 exemplified a significant shift in the landscape of financial markets, driven by the power of retail investors and social media. This event showcased the impact of meme stocks, where coordinated efforts by individual investors can lead to dramatic market movements. Easier access to trading, commission-free platforms, and the increased presence of capital markets in popular culture have all contributed to this phenomenon. While the incident raised questions about market stability and potential regulation, it also highlighted the evolving dynamics between institutional and retail investors. As the financial world adapts to these changes, the balance between opportunity and risk continues to evolve, reshaping the future of trading and investment.

References:

Cho, E., Kim, W., & Woo, M.-C. (2024). Positive Feedback Trading in Meme Stocks: Swing Trading or Betting on Lotteries? SSRN Electronic Journal. https://doi.org/10.2139/ssrn.4818837

Costola, M., Iacopini, M., & Santagiustina, C. R. M. A. (2021). On the “mementum” of meme stocks. Economics Letters, 207, 110021. https://doi.org/10.1016/j.econlet.2021.110021

Daniel, W. (2021, January 26). GameStop short-sellers have lost $5 billion this year as Reddit’s day-trader army squeezed their bearish bets. Markets Insider. https://markets.businessinsider.com/news/stocks/gamestop-short-sellers-squeezed-losses-reddit-traders-army-cohen-palihapitiya-2021-1-1030006226

Darbyshire, M., & Fletcher, L. (2021, June 25). Hedge funds rethink tactics after $12bn hit from meme stock army. Financial Times. https://www.ft.com/content/dcd86860-09ed-420e-a5cc-d6d281863c03

Darbyshire, M., & Platt, E. (2021, August 4). Robinhood soars after retail traders flock to shares. Financial Times. https://www.ft.com/content/a9017fe2-e24a-4224-b2fa-320be47853b7

Egan, M. (2019, December 13). This app completely disrupted the trading industry | CNN Business. CNN. https://www.cnn.com/2019/12/13/investing/robinhood-free-trading-fractional-shares/index.html

GameStop stock tipster Roaring Kitty reveals he lost $13m in one day. (2021, February 3). The Independent. https://www.independent.co.uk/news/world/americas/gamestop-roaring-kitty-reddit-youtube-b1797023.html

Kantor, A., Stafford, P., & Lewis, L. (2021, January 28). US trading volumes soar past 2008 peak in Reddit battle. Financial Times. https://www.ft.com/content/56658052-76fe-4910-8cb7-810039753f7c

Ponciano, J. (n.d.). Meme Stock Saga Officially Over? GameStop Short Interest Plunged 70% Amid $20 Billion Loss. Forbes. Retrieved January 16, 2025, from https://www.forbes.com/sites/jonathanponciano/2021/02/10/meme-stock-saga-officially-over-gamestop-short-interest-plunged-70-amid-20-billion-loss/

Rodrigo, C. M. (2021, January 28). Robinhood restricts trading of companies targeted by Reddit users [Text]. The Hill. https://thehill.com/policy/technology/536272-robinhood-restricts-trading-on-companies-targeted-by-reddit-users/

Staff Report on Equity and Options Market Structure Conditions in Early 2021. (2021). SEC.

Verlaine, J.-A., & Banerji, G. (2021, January 29). WSJ News Exclusive | Keith Gill Drove the GameStop Reddit Mania. He Talked to the Journal. Wall Street Journal. https://www.wsj.com/articles/keith-gill-drove-the-gamestop-reddit-mania-he-talked-to-the-journal-11611931696