Exploiting Cyclical Companies For Outsized Returns

This is a guest article from one of our members Hubert Nowak, originally published on Hubert's Substack blog "The Last Puff".

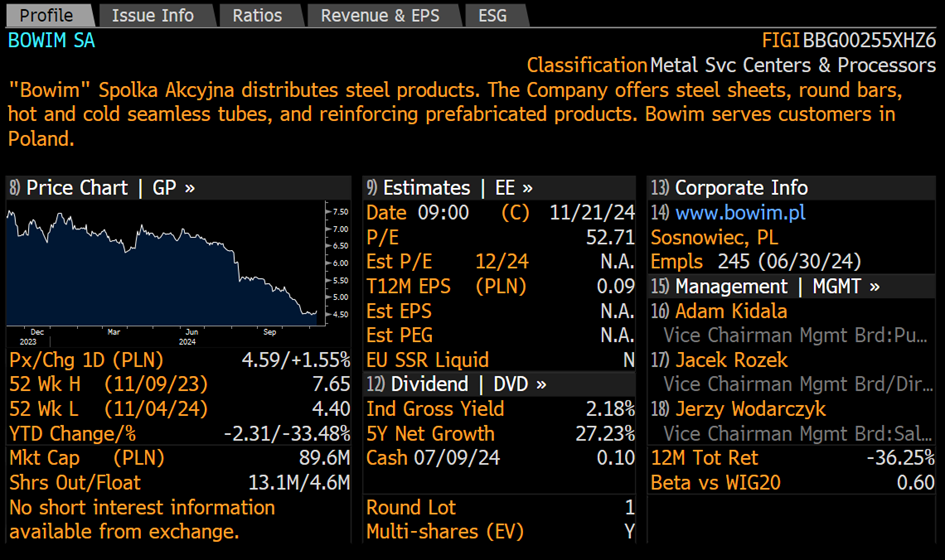

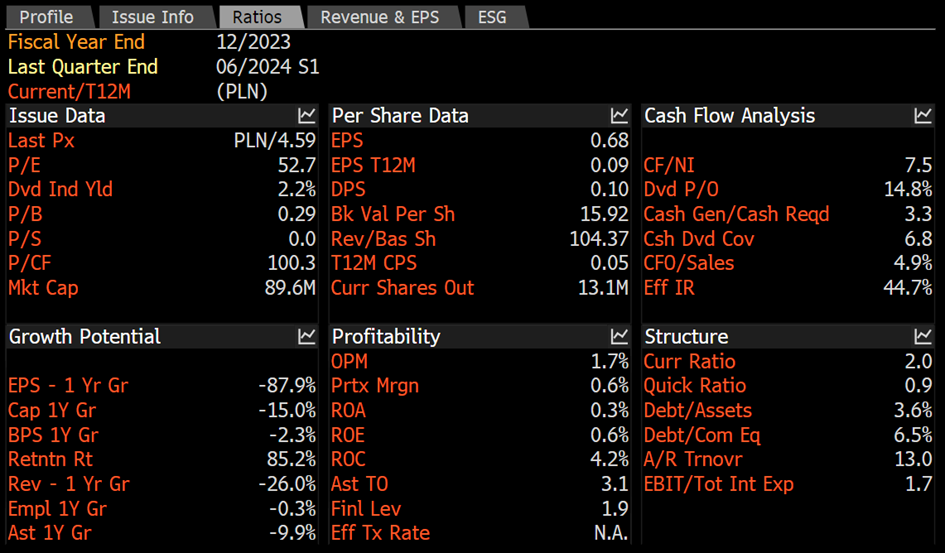

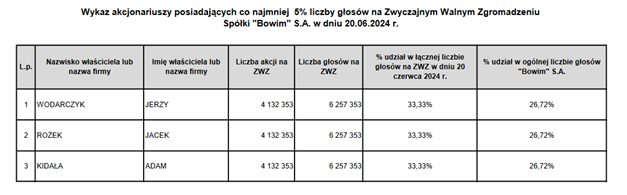

I recently invested in one steel products manufacturer that’s currently trading at just 28% of its book value, 62.5% of its NCAV, and less than half of my estimated liquidation value. Profitable every year since 2012.

Most of the assets are tied up in working capital, and debt levels remain minimal. The financial reports don’t show anything even remotely concerning, and with management effectively controlling the company, their incentives are reasonably aligned with shareholders.

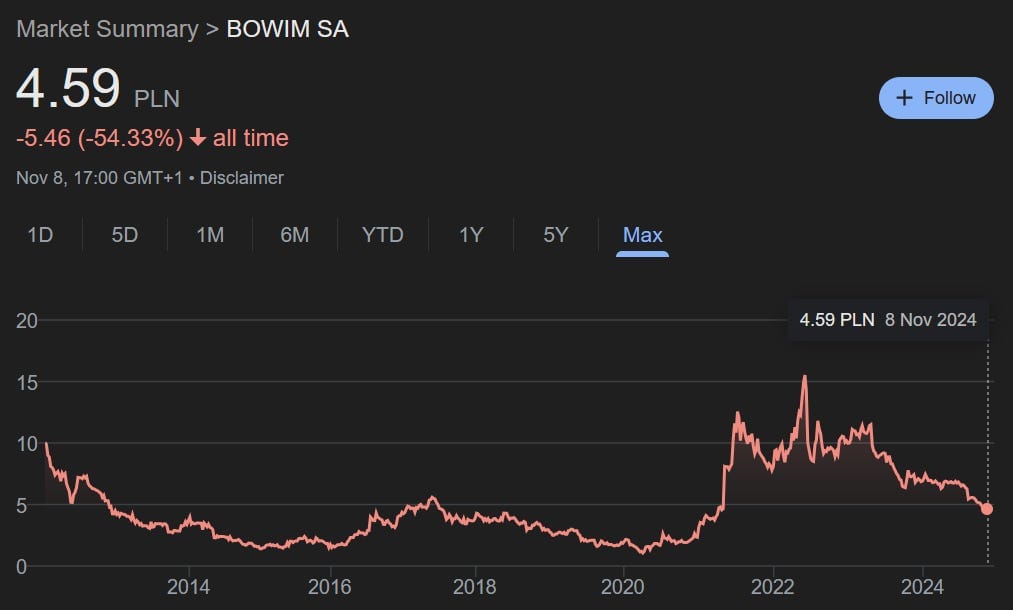

Since my last brief write-up, its stock price has dropped by nearly 30%:

(now that I think about it, that probably isn’t the best promotion for that article…)

The main culprit here was continued margin pressure from broader macroeconomic issues in the European steel industry, leading to a net loss of 0.34 PLN per share for the first half of 2024.

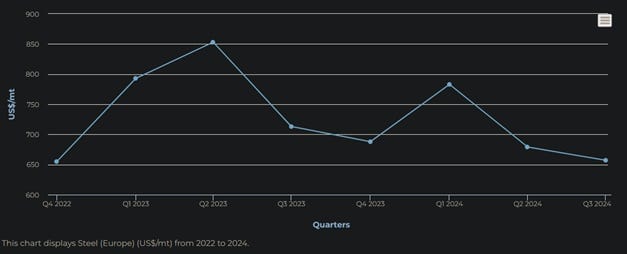

The main issue seems to be industry-wide rather than company specific. Steel prices have taken a nosedive since 2023 due to rising production costs squeezing earnings. There’s also less demand across Europe.

On top of that, Chinese steel imports are undercutting local prices, adding to the pressure.

So, it’s mostly macro stuff - nothing too complicated.

Historically, this company’s P/B ratio has ranged from as low as 22% in 2020 to as high as 177% back in early 2012. It wasn’t unusual to see it trade between 60-80% of book, so when things get better, there’s certainly a chance for this stock to double.

Why I love cases like that, and why you should too

What I like about these situations is that there’s nothing inherently wrong with the company itself. It’s just that the macro environment is getting worse, which naturally impacts current earnings and drags the stock price down.

But the industry will, at some point, get better. Earnings will get better.

And that’s all there is to it.

The play here is simple: find a good entry point, start with a small position, add more if it dips further, and let mean reversion work its magic. You see this a lot with cyclical companies - they may often not be of the best quality, sure, but they regularly get extremely undervalued. And when they do, you should exploit that.

Classic cigar-butt investing.

I know it sounds just too simple to work - that’s how the majority thinks as well.

And this, my friend, is key.

First, a success story

This reminds me of a company I used to have a significant position in a few years back - Universal Stainless & Alloy Products (USAP). It was in a very similar spot to the one I want to share with you today.

I first bought USAP at $10.50 per share back in 2021, starting with a small position. Just a few percent of my portfolio, no more than that.

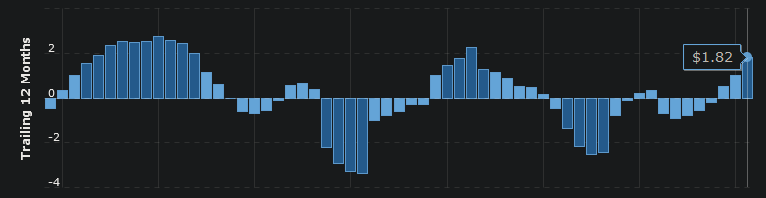

At the time, the stock was trading at around half my fair value estimates. It wasn’t anything special, but it looked cheap quantitatively. If you look at the chart below, you can clearly see the cycles and how market sentiment has swung over the years.

Since 2000, there have been 5 distinct opportunities just waiting to be exploited for an exceptional return.

This company is a perfect example of how cyclical industries work. There are good times, and there are bad times. Ups and downs are just part of the game. But when the extremes happen, the market starts acting like the current environment is the ‘new normal’.

When business is booming, people convince themselves that the growth will never stop. And when times get tough, suddenly everyone believes the downturn is here to stay

Do you see what I’m getting at?

The market tends to forget that in a cyclical industry, the bad times usually don’t last forever, just like the good times don't either. This disconnect creates some of the best opportunities for value investors.

It’s all about recognizing the cycle we’re in, buying when sentiment is at its lowest, and waiting for the inevitable upswing.

The company looked attractive on a quantitative basis. Debt wasn’t a concern, and there were plenty of catalysts:

- Market sentiment was at rock bottom, even though the company’s backlog was around $250 million - 3 to 4 times its market cap - and growing. But of course, just having a large backlog doesn’t mean much if the company is operating barely on breakeven.

- The aerospace industry, a major revenue driver for USAP, was hitting an inflection point. The company faced demand issues during the COVID lockdowns, but there were clear signs of improvement. While product prices hadn’t yet caught up with inflation, the company was adjusting them month by month. This gave me confidence that as inflation slowed and demand grew, profitability was likely to return. Management has consistently emphasized this point during earnings calls as well.

- Margins and earnings were on the rise, further strengthening my conviction. There was no justifiable reason for the stock to be this cheap. While it wasn’t worth $40, it also wasn’t worth just $10 per share, especially when you could liquidate the damn thing for probably twice that. Additionally, with insiders lacking majority control, a buyout offer became a realistic possibility.

So, I started buying shares. It was a classic 'buy low, sell high' scenario…

Timing could’ve been better

But, to my slight surprise, the stock kept sliding.

Down to $9, then $8.50, and then $8. With each drop, I kept digging to make sure I wasn’t missing something. But nothing convinced me that I was wrong.

When USAP was at its peak in 2018 the market acted like it would keep rising forever. At the bottom 4 years later, it seemed like the market thought that net loss would never again become net profit. But I knew otherwise. The signs were there.

The stock kept sliding, and I kept adding more.

I boosted my allocation to 10%. Then, 15%.

Then to 20% of my portfolio, as it dropped below $8 a piece.

It seemed like every time I thought it had hit the bottom, it went even lower. I decided to keep some cash aside, just in case the market got even crazier.

By the time it hit $6 per share, I had built it into a 30% position. I couldn’t justify such a low valuation with any logical reasoning. It was trading at ~30% of tangible book value. My calculations showed it was worth probably three times that. Both the steel and the aerospace industries were improving. Meanwhile, the market had completely given up on the company.

But, I knew I was right.

No borrowed conviction

This was before I even knew about Fintwit or the idea of a community of like-minded investors. My conviction had to come from just grinding through financial reports, doing my own research. I was simply following the logical steps that legendary investors had taken before.

It wasn’t until later that I found out this approach had a name - 'deep value'.

A lot has changed since I discovered Twitter. It was like finding a whole community of people who spoke the same language. People who saw value where others saw problems. It opened my eyes to a new world of opportunities, where complex situations with less competition could offer even better returns.

That’s also how I stumbled upon Orchard Funding Group.

Off-topic, but proves a relevant point

Value investing works because people are emotional creatures, prone to overreact in both directions.

The best opportunities, thus, often come from two sources: investors letting their emotions take over, or simply not doing the necessary work.

Although Orchard wasn’t a cyclical company, it exemplified a classic case where both dynamics were at play. After years of the stock’s relentless decline, frustrated long-time shareholders rushed for the exits. The price plummeted from 97p per share in 2015 to just around 37p at the start of 2024.

Over the next two months, the stock fell more than 50%, eventually reaching a bottom at just 20% of book value and a P/E ratio of 2. The tipping point came with the emergence of new regulations that would impact the company’s results. Most current investors hadn’t accurately assessed the extent of that impact, and the complexity of the situation deterred potential new buyers.

This created a setup ripe for outperformance - strikingly similar to the situation with Universal Stainless. A company left to die, forgotten.

It was, however, a lot more work…

Over the next two weeks, I immersed myself day and night, combing through every piece of information I could find. No detail was too minor; everything could be relevant. This wasn’t just about skimming reports; it was about understanding the business through facts, not rumors.

Unlike my experience with USAP, where I could build my conviction gradually as the stock fell, with Orchard there was this palpable sense of urgency in the air. Just as if that opportunity could vanish at any moment if the market caught on.

Hard work - reading every day until my eyes burned - was the only way to make sense of it all in time. I had to consciously choose the stock market over spending time with friends and family, acutely aware that I didn’t know how long I had before other investors discovered this opportunity.

There was no room for hesitation; I had to go all in from the start.

And, it paid off…

A month after my initial look at Orchard, the stock surged 70%. I got lucky, but more importantly, this was the result of doing diligent homework when others weren't willing to put in the effort. That kind of return-on-time-invested was incredibly good, especially with Orchard making up 15% of my portfolio.

…but it didn’t come easy.

The market was in full panic mode. Everyone and their mothers were selling, convinced that Orchard’s problems will ruin the company. I felt like I was standing alone, fighting against a tidal wave of pessimism. Even when I reached out to some of the sharpest minds I knew on Twitter, they weren’t biting. Sadly, no one was interested in joining in on the fun of sleepless nights and constant eye drop use.

And that is one way to approach investing.

Lessons learned

Orchard’s story wasn’t all that different from USAP’s. Both cases involved finding value that was actually quite obvious if you only looked closely enough. The market was too caught up in the noise to see that. The difference was in the approach:

USAP allowed me to ease in with a small position at first, then add more as I built conviction. The more promising the opportunity, the more work.

Orchard, on the other hand, demanded immediate action due to the sheer urgency of the situation. It was a solid company trading at just 20% of book value with a P/E of 2, after all. Opportunities like that don’t come around every day. The quantitative undervaluation was glaringly obvious. The real question was whether they will endure the recent issues. That was the qualitative part. And the latter is usually a lot more difficult than the former.

That experience taught me a key lesson:

In investing, the amount of work isn’t always linked to the size of the reward.

There are cases where value is hidden deep under the ground, which can take a lot more effort to uncover. When the fundamental signs are clear, as they were with Orchard, you often need to put in the time to confirm the facts - to assess the quality.

But not every opportunity requires complex modelling or hours of studying to reach a satisfactory level of conviction and a good potential return.

Sometimes, all you need to do is recognize when the market is visibly wrong and act.

That’s exactly why I pretty much always start with book value as a rough measure of value. My process is about keeping things simple. Spotting cases where value jumps right out at you. It’s just easier to scan for companies trading below book value, get a sense of their liquidation value, and figure out the chances of things getting better than it is to predict growth for the next 10 years or judge moat durability.

And the inherent inefficiencies in cyclicals make exploiting tangible undervaluations just too easy.

The company I’m about to discuss fits right into this approach. It’s trading at just around 28% of book value and 46% of NCAV. Profitable every year since 2012, but not today. And not because there is something wrong with it - it’s just cyclical.

Don’t get me wrong - there are plenty of people who do well focusing on growth stories and analyzing moats. That can work well too. But for me, the difference is that this way is just more straightforward and less time-consuming.

My returns have mostly come from sticking to this “easy” field. And if the simple way works so well, why complicate it?

Thanks to the magic of volatility, I discovered yet another net-net with an even more compelling valuation. It’s arguably one of the cheapest companies I've seen in the past few years in terms of fundamentals.

Currently, it trades at approx. 20% of book value, less than two-thirds of its NCAV, has low debt, and boasts a substantial cash reserve - all at a market cap of a few billion EUR. Just a few days ago, I added it to my net-net basket, allocating 6% of the portfolio to this position.

Since my last article, the industry as a whole has experienced further price declines, which impacted many of these companies. As a result, by the end of this article, I won’t just share one investment idea but 5 European net-nets worth considering - some from my portfolio, and some from my watchlist.

How It All Evolved For USAP

I bought shares in Universal Stainless & Alloy Products (USAP) when they were trading cheaply, with an average cost of between $6 and $7 per share, and sold all of them in parts 1.5 years later between $13 and $15 per share.

Little did I know, the big money came later.

Selling then turned out to be quite a mistake, as when I am writing these words (Oct. 2024), the share price sits at around $41 per share. I could’ve held on for longer because the industry was still rapidly improving, but I sold out, fearing that a potential recession might reverse those good trends and quickly bring in unpleasant headwinds to the industry.

After all, the value of my shares more than doubled since the initial purchase, and the price was getting close to my liquidation value estimates. As it turned out in the end, however, I was overly conservative with the calculations, which caused me to sell out prematurely.

That certainly was a mistake, but also a very much needed lesson. A lesson in courage – to let your winners run when everything points to a long road ahead.

At $41, USAP is a classic case of déjà vu from 2021, but in reverse - overvalued once again. I wouldn’t necessarily bet on shorting it, but I wouldn’t be surprised to see the future repeat itself somewhere down the road.

We won’t see a downturn soon because Universal just announced it’s being bought out at $45 per share. This news dropped on 17.10.2024 and, at that price, I’m unsure if Aperam is getting a good deal, but maybe they see something I don’t. Perhaps they can leverage their size and expertise to boost efficiency and improve the company in ways that the previous management couldn’t. Or maybe it’s just people being people again. I might be wrong, of course, but I doubt the company has changed as much as some think. Who knows?

Funnily enough, this stock has a history with some big names, as it was featured in Mohnish Pabrai’s book called The Dhandho Investor:

In aggregate, I considered it a bet very much worth making. Pabrai Funds first invested in Universal Stainless stock in April 2002. We bought our initial stake in the $14 to $15 per share range—putting 10 percent of assets under management into USAP.

The similarities between his journey and mine are oddly intriguing. Like when USAP’s management decided to install a new furnace, indicating that the company was prepping for better times. Even though the market practically forgot about this company, you could interpret that as somewhat of a sign of better times coming. That’s very similar to the kind of an expenditure they made while I was invested, almost 2 decades later.

In May 2005, the company decided to spend $2.5 million in capital expenditures to install a sixth vacuum arc re-melt furnace. I have a vague idea (at best) of what such a furnace is. What I did understand from Mac on a conference call is that it would raise EPS by about $0.50 per share annually (wow!)

As I am pening this paragraph on June 19, 2006, USAP’s stock trades at $25.65 per share. The market is concerned about weakening fundamentals for steel companies. USAP is not a typical steel company. While big industry trends do affect it, it is in an insulated niche. Its aerospace and energy industry customers are having their best years ever. USAP’s business prospects have never looked better. Their backlog has never been stronger.

Source: Mohnish Pabrai, The Dhandho Investor: The Low-Risk Value Method to High Returns, p.157-165

This mirrors my own experience remarkably well - just like USAP's trajectory back in the day. And it highlights a broader point: inefficiencies in cyclical stocks have a tendency to repeat themselves.

Of course, for this strategy to work, you need a portfolio of companies like that. An appropriate level of diversification is a fundamental part of deep value investing, as it may happen that some of your picks just don’t get back to the assumed sell price for a long time. By diversifying, you effectively play along with the law of large numbers - the larger the sample of companies with similar prospects, the closer your return is to your desired results, additionally decreasing, or even in some cases completely minimizing, the adverse effects of many company-specific risks.

And I specifically wrote “companies with similar prospects” for a reason - if you increase your sample size by buying worse opportunities, you may be taking away some risk, but you are also, in effect, killing your overall returns.

Achieving “proper” diversification

Some people say 8 companies in a portfolio is enough, others say that 20-30 is the bare minimum for achieving “proper” diversification. I say - it all depends.

You can bet heavily when the odds are stacked in your favor, but the size of your investment should come from your conviction which should be, in turn, based on:

- How undervalued the company is.

- How sure you are about its future.

- How good of an analyst you really are.

Different risks exist, and many we are not even aware of until they actually hit us in the face. Buying cheap does not guarantee any profit. But if you have, say, 20 or 30 such deeply undervalued stocks in your portfolio, the law of large numbers is on your side.

Of course, you won’t be able to eliminate risk entirely. As some people say, shit happens (forgive my language). There are net-nets structured so that they allow for a larger allocation, and there are those which suggest that wider diversification is a better idea.

And it’s not only about downside protection either. If you hold just one company in your portfolio and it takes it 5 years to double (your sell price), that’s 14.87% annual portfolio return. But if you have two companies in your portfolio, one of them doubles after 5 years and the other one in 3 years, not only is your overall annual return even higher than that, as the second company gave you your assumed return well before the 5-year mark, but you are then also able to invest the proceeds in some other opportunity much sooner than you would if you were holding just one stock. Unless you’re absolutely certain about just a few selectively chosen cases, a slightly higher sample size than just a few stocks is probably beneficial.

That is why I personally try not to close myself in brackets of self-imposed diversification rules. If there are enough companies that make me comfortable enough with putting 20% of my portfolio in each, I’ll hold only five companies. If there are no cases that provide me with so much conviction, I’d be happy to buy many at, say, 3% allocation. It all depends on the how the market looks like and also on the number of available opportunities. And in the case of USAP, it once reached 30% of my portfolio with no other company in my portfolio of similar size back then - the rest of my picks were likely closer to 5% each, on average. And if it weren’t for that size, you wouldn’t be reading this article now.

Correct sizing matters more than you think.

Some companies may go down further, widening the gap between price and value, and offering a chance to increase your investment size. Others might deteriorate, eating through your margin of safety and your potential returns. But if you avoid high levels of debt, shady managements, permanently unprofitable enterprises and other such ventures of higher risk, you don’t have to worry that much. If you do your homework and buy things when they’re really cheap, history, as well as mean-reversion are on your side.

Caveat Emptor (Buyer Beware)

Of course, the process of stock analysis is much more complicated in real life than what I describe here – it’s not like you should buy stocks purely based on a 5-minute analysis purely because something has a low price-to-book ratio (although I know people who specialize in this exact thing, and with surprisingly good results too!).

The way I structured my words is, partially, to tell a good story, but mainly to stress how lucrative investing in companies with a large discount to tangible asset value can be, and that such opportunities come up over and over again. It’s not the only metric I look at, obviously, but it is the most important one.

It's essential to weed out any possibilities of falling into value traps. So, as simple as my words may sound, it’s never just all about the numbers.

With USAP, I can’t express how many hours I’ve spent making sure my thinking is sound. Achieving such conviction is my requirement for making any stock a substantial portion of my portfolio. If I can’t get a high conviction, I limit my investment to just a few percent. That is my self-imposed iron rule.

Downside protection is far more important than any potential gains, no matter how sweet the upside might seem. Deep value, this strange and unintuitive method works because if you win, you enjoy a nice return on the capital invested, but more importantly when you lose, you typically don’t lose much – but only if you have correctly assessed the margin of safety. That is the source of alpha in this investing method - downside protection.

And on top of that, you also have the magic of deep value cyclicals. You can either chase the dream of perpetual growth, bidding prices up regardless of fundamentals alongside the rest of the speculators, or you can wait patiently and pounce when others are running for the exits. Most of my returns come from playing the investing game the second way. These types of inefficiencies are simply too lucrative to ignore.

Today’s company feels a lot like USAP once did. It may not be at the bottom yet (I hope so!), but it’s close enough to start a position at two-thirds of NCAV. If it goes lower, I’ll do more work and probably allocate more capital, depending on how things develop. For now, let’s wait and see.

Short summary

Bowim has recently dipped to about 66% of its NCAV, which is typically my point of interest with stocks like this. Nowadays, I require a much larger discount before buying. However, in this case NCAV was not the only relevant metric, and I deemed it a good idea to allocate a small amount of money into its shares, since it’s trading at around half of liquidation value estimates, but also because Bowim falls into one of my favourite categories – cyclical companies.

Q1 was a profitable quarter, but Q2 brought some challenges, mainly due to macroeconomic headwinds currently affecting all European steel producers.

Predicting whether this trend will persist for long is tricky, so I’m keeping a close watch on how it all unfolds. At the current price, I’ve only made it a small position due to the opportunity cost of my other ideas, but I plan to add more if it drops further.

For those interested in digging into the numbers yourself, check out Bowim’s financials here. You can use your browser’s built-in translator if your Polish is a bit rusty. I also recommend using this translator for translating annual reports in PDF: Online Document Translator, which I first found extremely useful when analyzing Japanese stocks - Google Translate often falls short in that regard. For some reason, this one translates stuff better and it’s all more comprehensible, so it also works wonders for Polish stocks.

The numbers

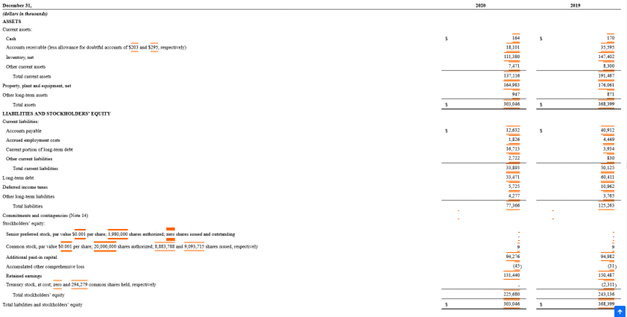

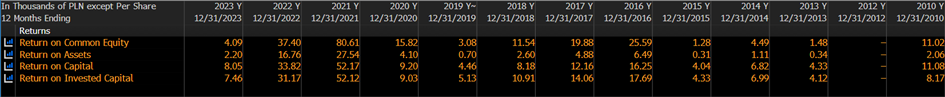

Most of Bowim’s assets are tied up in working capital, with minimal long-term debt. They also have plenty of revolving credit available if they need extra cash some day. This structure reduces insolvency risk significantly. Insiders effectively control the company, owning over 80% of the shares, which aligns management’s interests with the shareholders:

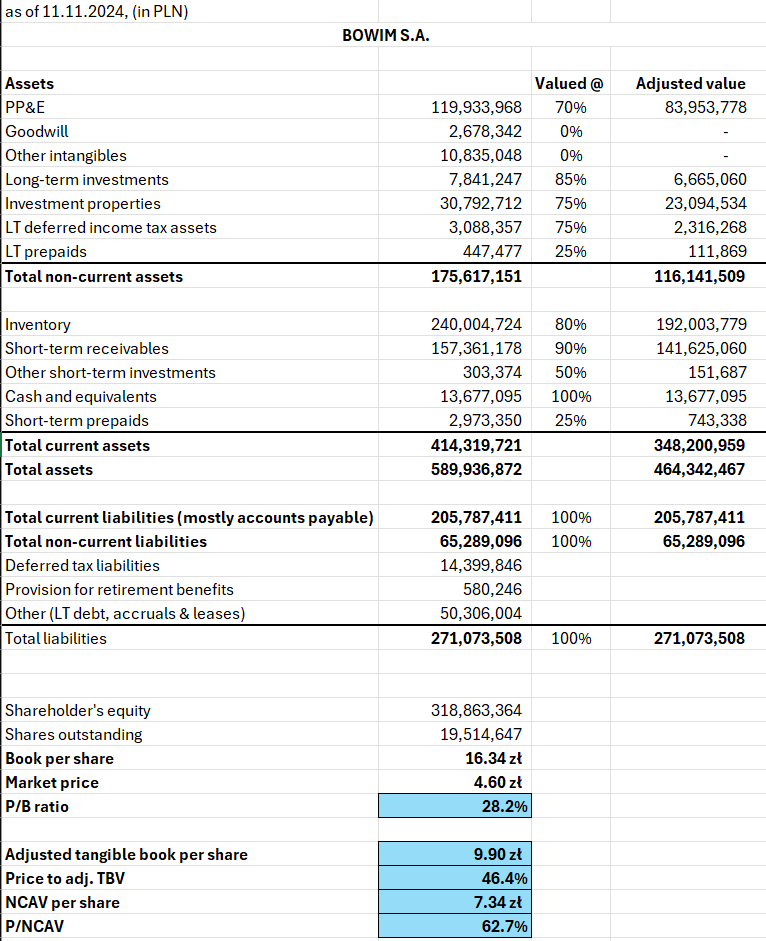

It’s not a great company, but it’s not a terrible one either - and that’s the key. Bowim has been consistently profitable for the past decade, and with the price-to-book ratio hitting 100% when conditions were better (back in 2017), a double is certainly possible after the industry somewhat recovers from the recent shocks.

The chart itself may not look too enticing, as it seems like the company is still historically pretty expensive, but that is only due to the extraordinarily good returns post-COVID and after the Ukrainian War started, which caused steel prices in Europe to skyrocket. One useful measure I like to look at in such cases is historical price-to-book values, to account for any “contaminants” of the true market valuation, and understand how the company was valued in the past based on normalized earnings.

Even in a pessimistic scenario where Bowim were to lose 1 PLN per share annually for the next four years - which would lower the book value to 12.34 PLN - the current share price would then still represent just 37% of book value. For context, this would still be nearly three times the 2019 book value, so I think that the odds are tilted in favor of us value-seeking investors.

If you’re thinking of waiting for a better price, that’s fair - the market trends are on your side. I doubt the steel industry has bottomed out yet, so there’s a chance Bowim could become an even better bargain in the coming months.

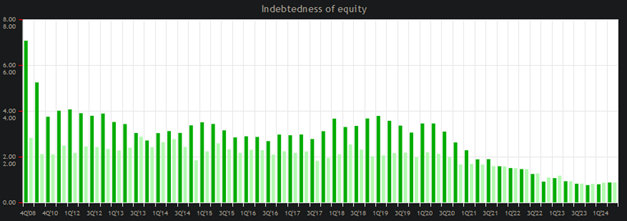

The debt

After some exceptionally good years post-2020, Bowim was able to significantly decrease its debt size. This makes for an even better opportunity than in the past:

After 2020, they invested heavily in expanding the production capacity. This has obviously led to increased inventory levels, which now stands at historic highs. On one hand, current steel pricing makes it difficult to extract favorable returns from this inventory. On the other hand, if margins improve and demand picks up, Bowim’s expanded scale could translate into record-breaking profits. This is exactly what I like to see.

Interestingly enough, when comparing the figures from a couple of the last quarters, it seems like the company has already started reducing inventory levels, so it’s possible we might see more cash on the balance sheet in 2025 although, as we know it, Bowim currently operating at a slight loss, so that cash may serve to cover operating losses.

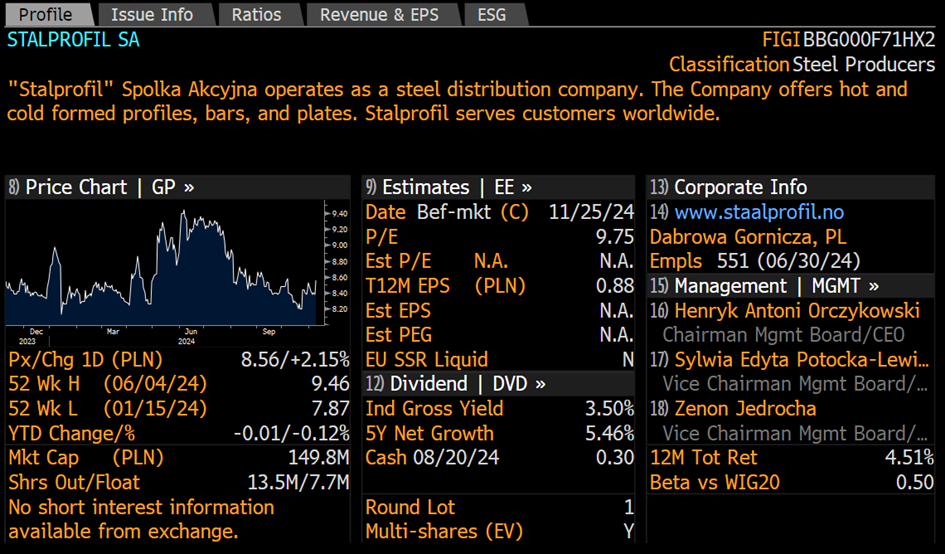

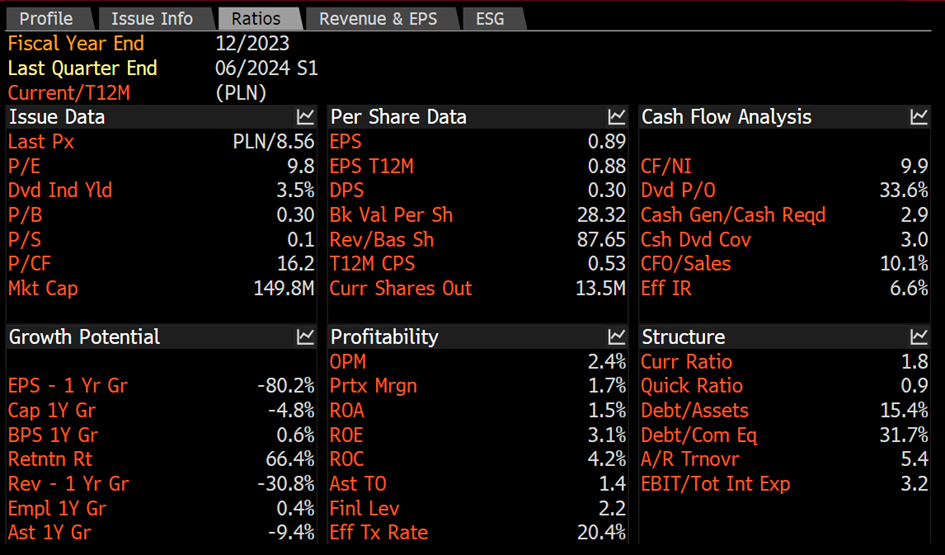

Stalprofil (STF.WA) As A More Attractive Option

While Bowim presents an intriguing case, Stalprofil (STF.WA) stands out even more, currently making up about 5% of my portfolio. For those who have read my previous analysis, the fundamentals haven’t changed much since, except for a small 10% dip in stock price – an even better entry point for new investors.

Stalprofil earned 0.56 PLN per share in the first half of 2024 and has maintained profitability, unlike Bowim. The company is constantly securing new contracts for gas pipeline construction in Poland, something that protects them from the current macroeconomic challenges and keeps them profitable. Preliminary reports for the upcoming quarter suggests that these contracts should continue to support profitability for quite a long time. And of course, more and more pop up regularly.

The situation in the domestic gas pipeline construction market in the first three quarters of 2024 was decidedly better than in the steel market. After a two-year investment stagnation, large tenders for the supply of insulated steel pipes and the construction of gas pipelines were launched this year, mainly related to the construction of the onshore section of the FSRU terminal. The Company has been regularly informing about its participation in these tenders in stock market reports, and the tangible effects of these tenders should be visible in next year's results for both the Group and the Company itself.

Source: refinitiv.com, translated

That's why Stalprofil is a larger position in my portfolio. Not only is it trading at a ridiculously low 30% of book value (after adjusting for minority interest), but its diversified business model also helps it stay afloat and avoid losses, even amid the worst industry conditions in years.

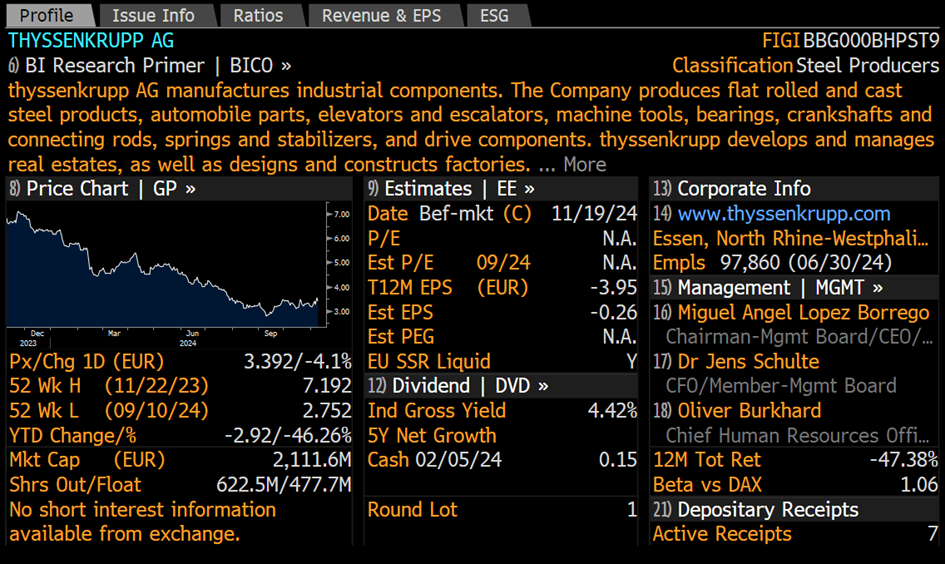

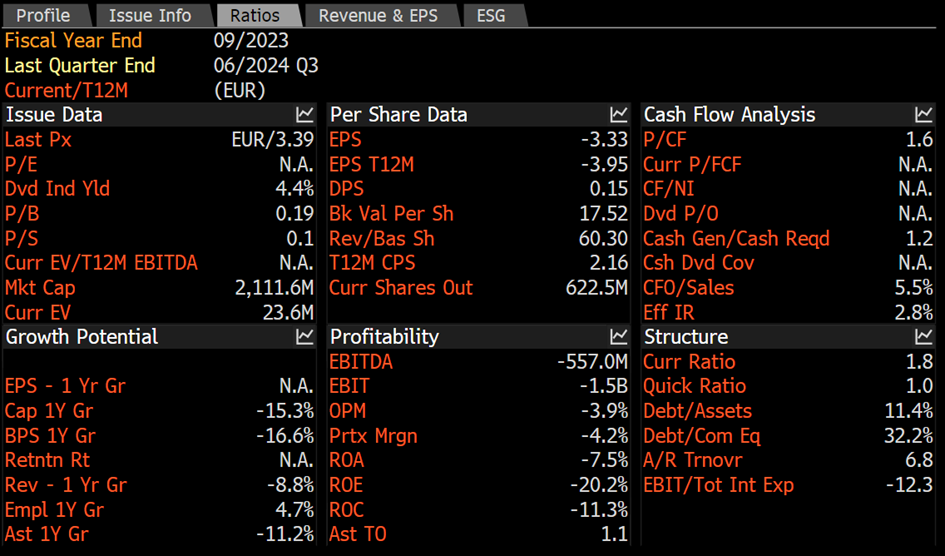

Thyssenkrupp (TKA.DE)

I don’t think I need to elaborate too much here – Thyssenkrupp is one of the largest European steel companies, currently trading at just 19% of book value and under two-thirds of its NCAV. Probably one of the cheapest companies I have ever seen too, given that it is not some speculative microcap, but a well-established enterprise with some long and interesting history (yes, Thyssenkrupp supported the Nazis during WWII - which is something that you just cannot miss while reading all of the bearish comments on the company. For some reason, I just can’t seem to grasp how that is relevant for the investment thesis). The company boasts a healthy cash reserve on its balance sheet, low debt (most liabilities are working capital and employee pension provisions), and unsurprisingly, struggles with some really negative market sentiment. Given current industry conditions, Thyssenkrupp is operating at a slight loss.

After some brief analysis, I concluded that the company is far from any bankruptcy risks. Even if I end up waiting five years for this investment to get back to, say, €9 per share (representing a 2.5-3x increase from the current share price - nothing impossible), that would still give me an annual return of about 20-25%. I will probably write a more detailed analysis of Thyssenkrupp in the future.

Management has already announced cost-cutting measures and a planned spin-off of one of the company’s divisions, which might serve as a tiny catalyst to some degree. For quite a while now, the important issue investors had with the company is its operations “going green”, to comply with the emissions standards imposed by the EU. The stock price was definitely negatively influenced by the potential high costs to be incurred during the process, but last month, the management said that they are “rethinking plans for green steel”, due to unfavorable industry conditions and high expected costs.

In my view, it sounds like a wonderful idea to stop burning money when facing such adverse industry environment and simply resume chasing the green dream after things stabilize, but the market reacted negatively, pushing the price down even further. Some people just cannot be pleased…

There's still a lot of skepticism surrounding the company and its management - and some of it certainly justified. The timing of any potential payout remains uncertain as well. Yet, the tangible margin of safety combined with the return potential was simply too large for me to ignore. After all, if everyone could predict exactly when things would improve, the stock wouldn’t be trading at such a steep discount, would it? Michael Burry, the guy you might recognize from The Big Short, once said something like “A catalyst is not necessary - sheer, outrageous value is enough”, and I personally agree with that. I might be early, but I don’t think I’m wrong here.

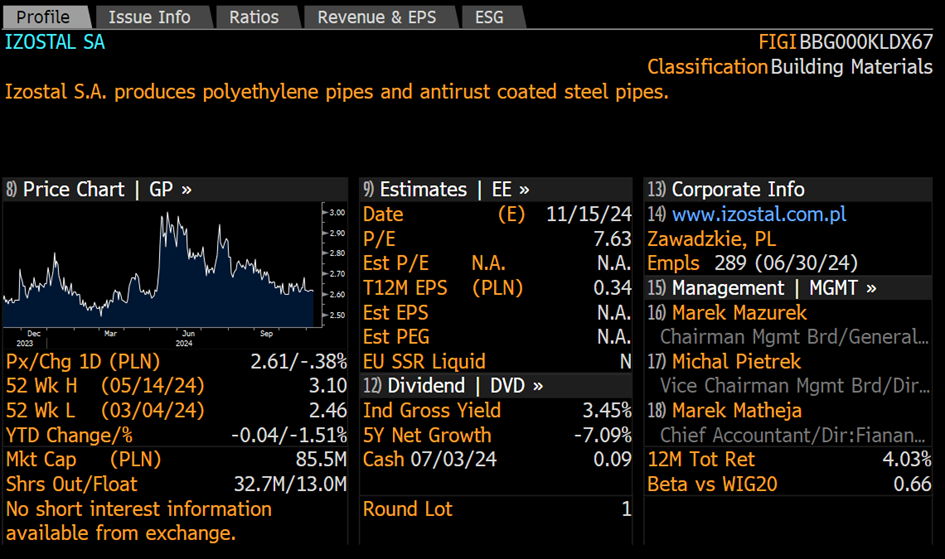

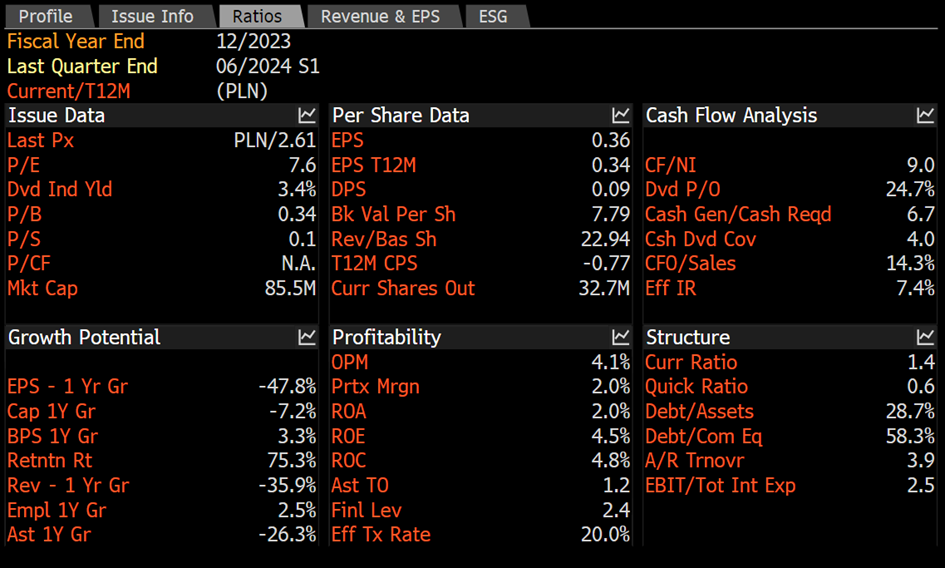

Izostal S.A (IZO.WA) - On My Watchlist

Izostal S.A. is yet another company from the steel industry with a situation similar to Bowim’s. It’s actually a subsidiary of Stalprofil, and so holding Stalprofil shares also provides indirect exposure to Izostal at the same time (and they are partially responsible for many of those favorable gas pipes contracts previously mentioned). The fundamentals align with the theme: trading at just 34% of book value and a P/E ratio of ~7.7. To sweeten the deal, the 3.4% dividend yield can make the wait more palatable.

I haven’t established a position in Izostal yet. My target entry point would be around 2 PLN per share. It may reach that level, or it may not, but it's certainly staying on my radar. For context, the company reached 128% of its book value in Q2 2016, so with a favorable market shift and a touch of mean-reversion magic, significant upside is a possibility.

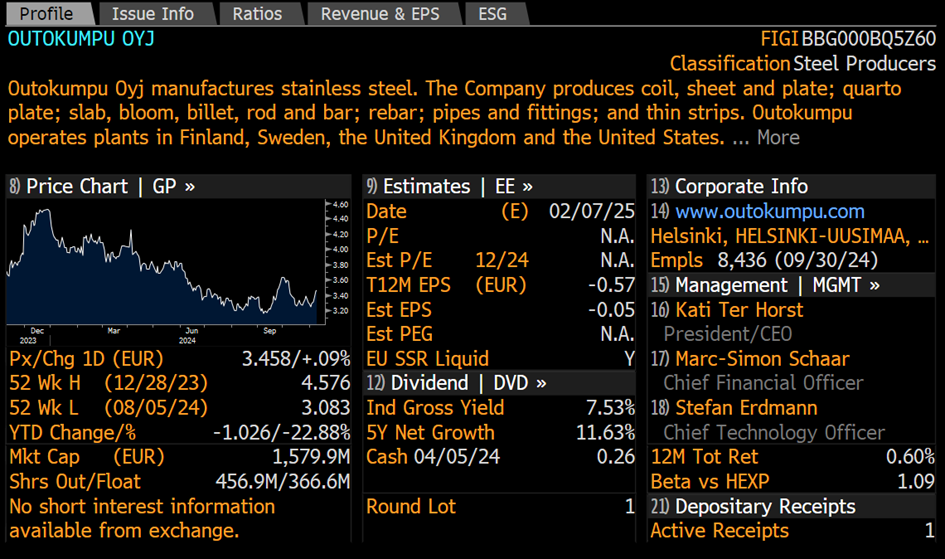

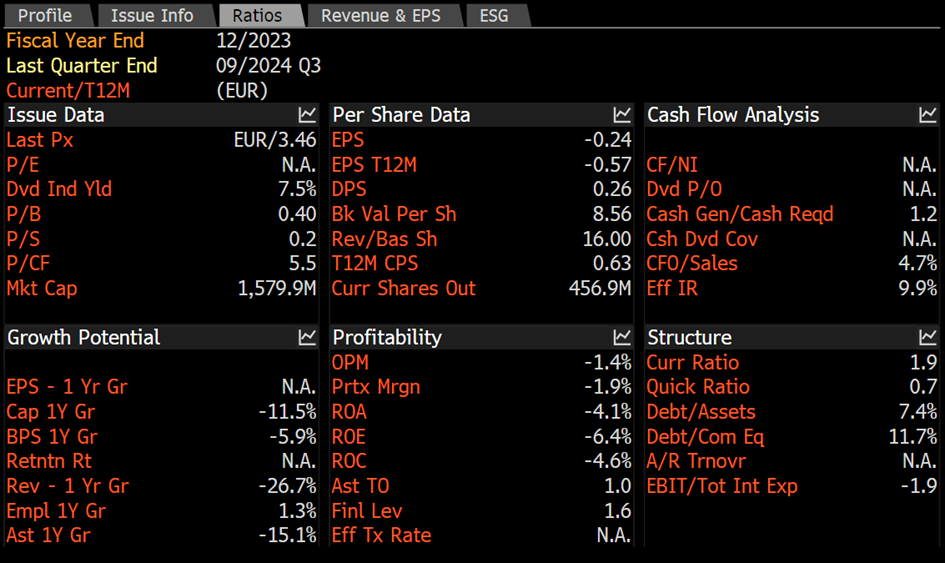

Outokumpu (OUT1V.HE) - A Reader Suggestion

One of my readers on Twitter, goncalovalue1, recently recommended looking into another undervalued steel company: Outokumpu (OUT1V.HE). I haven’t had the chance to do a deep dive yet, but if you're interested, here are some key stats:

Be sure to check out his website, Value Hunter, where his analysis of Outokumpu should be published soon.

I hope you’ve had good time reading this article, and I really appreciate you being my subscriber - if you have any thoughts or suggestions you’d like to share with me, be sure to leave a comment!

And as always, good luck and happy hunting!

Stonks Value

This has been a guest article from one of our members Hubert Nowak, originally published on Hubert's Substack blog "The Last Puff".